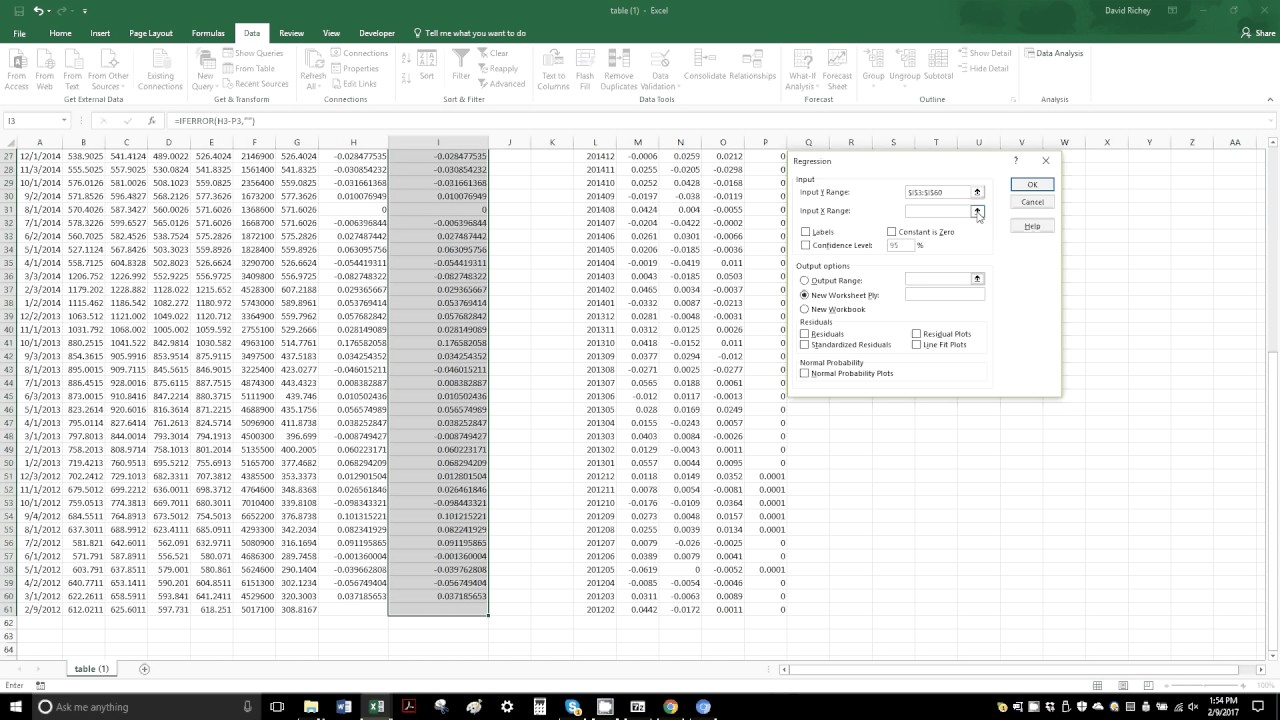

Analyzing Sharpe Ratios on Fama French Top/Bottom 20% and 30% Portfolios in Python | by Abdul Qureshi | Medium

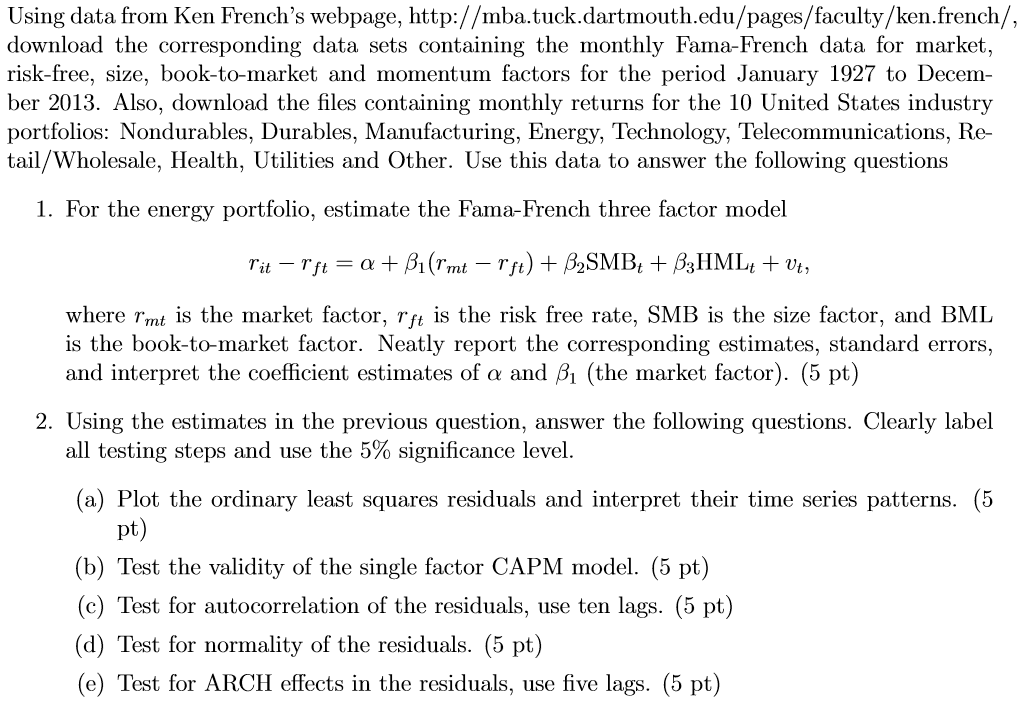

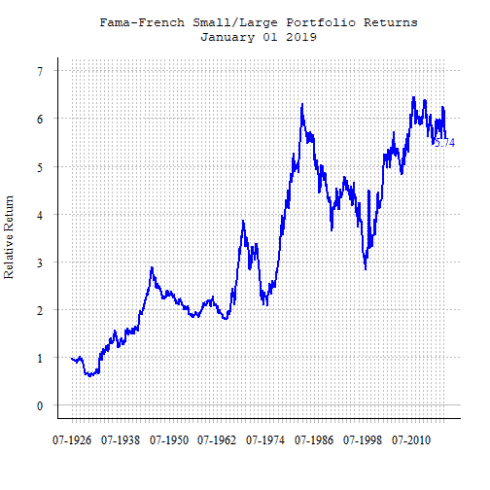

Construction of the Fama-French-Carhart four factors model for the Swedish Stock Market using the Finbas data

Comparison of CAPM, Three-Factor Fama-French Model and Five-Factor Fama- French Model for the Turkish Stock Market | IntechOpen

![Testing the new Fama and French factors with illiquidity: A panel data investigation [*] | Cairn.info Testing the new Fama and French factors with illiquidity: A panel data investigation [*] | Cairn.info](https://www.cairn.info/vign_rev/FINA/FINA_393.jpg)

:max_bytes(150000):strip_icc()/fama-4196653-b2f48bc85216461ab6f626e63818552c.jpg)

![PDF] Constructing Fama-French Factors from style indexes: Japanese evidence | Semantic Scholar PDF] Constructing Fama-French Factors from style indexes: Japanese evidence | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/397dd187570bdad8f4a1ee18a96a4a5d7a3f59bf/6-Table1-1.png)